On October 9, 2025, China’s Ministry of Commerce issued the “Decision on Implementing Export Controls on Rare Earth-Related Technologies.”

The following day, Friday, U.S. President Donald Trump announced that in response to the “hostility” demonstrated by this control policy, the United States would impose an additional 100% tariff on Chinese goods starting November 1.

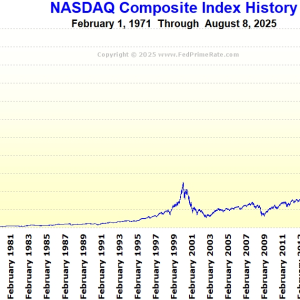

The news sent markets into a tailspin. The Nasdaq 100 Index plunged 3.5%, while the S&P 500 Index fell 2.7%.

Cryptocurrencies also took a heavy hit: BTC plunged 14%, ETH crashed 23%, and Doge plummeted nearly 80%.

My position status:

I hold Nasdaq index and cryptocurrency (Doge, BTC) spot positions. A small portion is staked in AAVE, and even at a 60% staking rate, it got liquidated.

The lesson: staking tokens to increase liquidity backfired—my position liquidated in under a month. From now on, I won’t touch contracts or staking.

Spot holdings will recover eventually. This crash cleared out excessive leverage, accelerating the bull market’s arrival. Holding spot positions feels reassuring.