In the investment world, we often encounter complex numbers and models. However, some simple yet practical financial rules can help us make quick judgments and decisions. Today, we’ll talk about three classic rules of money management: the Rule of 72, the 80/20 Rule, and the 4% Rule. They provide us with direct insights into capital growth, wealth distribution, and retirement planning.

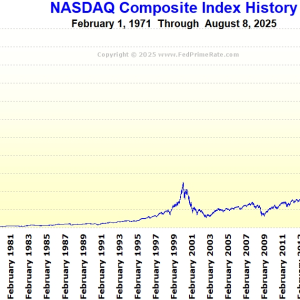

The Rule of 72: Understanding How Fast Your Money Doubles

If you often invest in stocks, funds, or other financial products, your biggest concern might be: how long will it take for your money to double?

The Rule of 72 helps you solve this question, and the formula is simple:

👉 Years to Double ≈ 72 ÷ Annualized Return Rate

For example:

- If the annualized return rate is 8%, your investment will double in about 9 years.

- If the annualized return rate is 3%, your investment will double in about 24 years.

This method is quick to calculate and easy to understand. Of course, it’s only an approximation and does not take into account factors such as inflation or taxes. But it is still a very practical tool for everyday financial planning.

The 80/20 Rule: The Secret Behind Wealth Distribution

The 80/20 Rule, also known as the Pareto Principle, is based on the idea that 20% of the factors determine 80% of the results.

In the financial field, this principle is very common:

- 20% of the people hold 80% of the wealth.

- In investing, 20% of high-quality assets can generate 80% of the returns.

For ordinary investors, the key takeaway from the 80/20 Rule is:

- Don’t spread your energy across all investments. Instead, focus on the most valuable 20%.

- When it comes to spending, control unnecessary expenses and focus on what truly matters.

In other words, we need to learn to focus, and spend our limited time and resources on the most worthwhile areas—not only in investment, but also in life.

The 4% Rule: The Golden Ratio for Retirement Planning

Many people worry that after retirement their money won’t be enough, or that they’ll spend it too quickly. To address this, financial experts in the U.S. came up with a classic guideline: the 4% Rule.

The idea is simple: if you retire with a certain amount of assets, and you withdraw 4% of it each year for living expenses, your money can theoretically last for 30 years or more without running out too quickly.

For example:

- If your retirement account holds $1,000,000, you can safely withdraw $40,000 per year to cover your living expenses.

- If you want $100,000 a year in retirement, you’ll need to prepare roughly $2.5 million in assets.

Of course, this rule assumes that your money is invested in a balanced portfolio (such as a mix of stocks and bonds) and that you take into account factors like inflation and market fluctuations. It’s not a foolproof formula, but it serves as a clear starting point for retirement planning.

Summary: The Power of Combining Three Rules

- The Rule of 72: Helps you quickly estimate how long it takes for your investment to double.

- The 80/20 Rule: Reminds you to focus on the critical 20% instead of spreading yourself too thin.

- The 4% Rule: Provides a benchmark for planning your retirement withdrawals.

When used together, these three rules give you a clear framework for investing, wealth management, and retirement planning.

Financial success doesn’t happen overnight—it requires long-term planning and rational thinking. With these simple mathematical rules, we can make the complex world of finance more straightforward and manageable.