On Wednesday, September 18, the Federal Reserve (Fed) announced a significant rate cut of 50 basis points, marking the first such reduction in over four years. The target range was lowered to 4.75%–5%. After more than a year of rate hikes, every meeting on interest rate adjustments has garnered international attention. Today, let’s explore the story behind the Federal Reserve.

The Rise of the U.S. Dollar and Its Global Dominance

Before discussing the Fed, it’s essential to understand the history of the U.S. dollar. The dollar’s origins date back to the American Revolutionary War when various currencies circulated, such as Continental currency and Spanish silver dollars. However, it wasn’t until the American Civil War (1861-1865) that the U.S. once again faced a financial crisis. To fund the war effort, President Lincoln’s administration issued Greenbacks — paper currency not backed by gold or silver but by the U.S. government’s credit.

The Legal Tender Act of 1862, passed by Congress, declared Greenbacks as legal currency. Although the large issuance of paper money caused some inflation, it was a necessary emergency measure to prevent the government from going bankrupt.

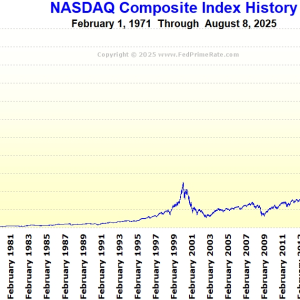

After World War II, the Bretton Woods Agreement was signed in 1944, officially establishing the U.S. dollar as the world’s dominant currency. The agreement pegged the dollar to gold, with 1 ounce of gold equivalent to $35. This allowed foreign governments and central banks to exchange their dollars for gold. However, this system only lasted 27 years. In 1971, facing a severe fiscal deficit due to the Vietnam War and a shortage of foreign reserves, President Nixon suspended the dollar’s convertibility to gold, thus ending the dollar’s link to gold.

The Role of Banks

Banks play a crucial role in currency circulation, mainly handling deposits and loans. By adjusting interest rates, the Fed influences the interest rates banks offer on deposits and charge on loans. Banks take in deposits from individuals and lend out money to those in need, profiting from the difference in interest rates. Internally, banks are required to maintain a reserve ratio — the portion of deposits they must hold and cannot lend out.

The reserve requirement ratio dictates how much of a bank’s deposits must be kept in reserve. With a 10% reserve ratio, banks can use the money multiplier to calculate how much total money the banking system can generate. The formula for the money multiplier is: 1/reserve ratio. With a 10% reserve ratio, the money multiplier is 10. This means that for every dollar deposited, the banking system can create $10 in total deposits. For instance, if someone deposits $10,000, through multiple cycles of deposits and loans, the banking system can create $100,000 in total money.

The Dual Nature of the Federal Reserve

The Federal Reserve (Fed) serves as the central bank of the United States, with both public and private characteristics. Its primary responsibilities include adjusting monetary policy to control inflation, promote economic growth, and ensure full employment. The Fed controls the supply of money and holds the authority to issue U.S. dollars.

One of the key tools the Fed uses to regulate the economy is open market operations, where it buys or sells government bonds to adjust the money supply. When the Fed needs to increase the money supply, it purchases government bonds, injecting funds into the market. But what does the Fed use to buy these bonds? It writes a check, essentially a blank check, which the U.S. government acknowledges. In this way, the Fed creates money by writing these checks, and the government bonds can be seen as IOUs.

This process of issuing blank checks to purchase government bonds is the Fed’s way of creating dollars. Over time, this accumulation of IOUs creates an ever-increasing national debt. As of now, the U.S. debt has reached a staggering $30 trillion, and the cycle of “borrowing new debt to pay off old debt” seems inescapable, resembling something like a Ponzi scheme.

The Rise of Digital Currencies

In the aftermath of the 2008 financial crisis, a mysterious figure known as Satoshi Nakamoto published the Bitcoin white paper and mined the first Bitcoin. The original intent of Bitcoin was to counteract the government’s unchecked printing of money and to combat inflation. Unlike traditional currencies, Bitcoin operates without a centralized authority or the need for trust in intermediaries.

Since its creation in 2009, Bitcoin has gradually gained acceptance from individuals, institutions, corporations, and even governments. With its decentralized nature and limited supply, many view Bitcoin as a potential replacement for traditional currencies in the future. As more people adopt Bitcoin and other digital currencies, it seems likely that digital currencies may be the next major revolution in the financial system.

For more information on the differences between Bitcoin and the U.S. dollar, check out my other article, “Cryptocurrency vs. The Dollar: A Revolutionary Financial Showdown.“

The history of the Federal Reserve is filled with complex decisions and economic trade-offs. From controlling interest rates to managing national debt, the Fed has been at the heart of the global financial system. However, with changing economic dynamics and the rise of digital currencies, the future of the monetary system could see a significant transformation. Time will tell what lies ahead.